Tags: accounts, bookkeeping, government, HMRC, making tax digital, NIC 2, returns, Revenue, self assessment, SME, tax, tax return

HMRC Announce Plans to Increase Support for Mid-Sized Businesses

This week HMRC have announced they are to increase support for mid-sized businesses to help as they move towards expansion. In order to qualify these businesses must have more than 20 employees or a turnover of over £10 million. This new Growth Support Service will offer specialist tax experts’ advice tailored to the individual business. If you meet the criteria you can apply online. This service follows the introduction of the Small Business Online Forum last month. This online service provides support for newly launched businesses and those self-employed. If you require one-to-one support with your financial records or would

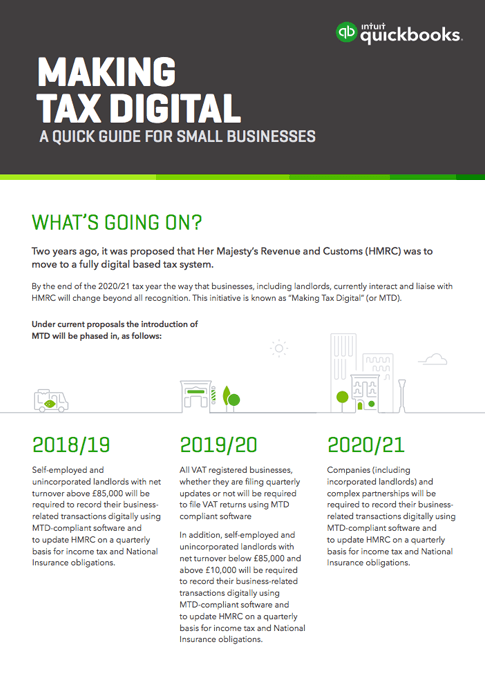

Making Tax Digital

Two years ago it was proposed that HMRC was to move towards a fully digital based tax system, making tax digital or MTD for short. This affects all businesses and by the end of the tax year 2018/19 these changes may affect you and your business. By 2020/21 all businesses will be affected. These changes are coming and you will be expected to update HMRC every quarter. Quick Books have produced a guide which can be downloaded here. HMRC have information on their website regarding these changes. If you have any queries as to how you will be affected and

U Turn on Budget Plan

In a surprise move, Chancellor Hammond reversed his decision announced in the budget little more than seven days ago. Amid controversy over the possibility of the proposed changes being in contravention of a manifesto pledge, the U turn overturned plans which would have affected small business owners and the self-employed. The letter Chancellor Hammond sent to the Chair of the Treasury Select Committee, ahead of this announcement today can be read here on the .gov website. So where does this leave you, the self employed, small business owner? I can advise on all your tax, NIC and VAT queries. I

The Autumn Statement and YOUR Business

Update for business owners. The Autumn Statement was Chancellor Philip Hammond’s first major announcement since taking office. As well as new information about the state of the UK economy, it included some key points for small businesses. Tax The tax free personal allowance will rise to £12,500, and the higher rate threshold to £50,000, by the end of the parliament. The personal allowance will rise at least in line with inflation from that point. The Chancellor said the government had put a “business-led recovery” at the heart of their plan. Following this, he confirmed that corporation tax will fall to

-

-

-

-

/ 0 Comments